A Comprehensive Guide For Tax Professionals

Drake Tax is a powerful tax preparation software that has gained immense popularity among tax professionals due to its user-friendly interface and comprehensive features. In this article, we will delve deep into the capabilities of Drake Tax, its benefits, and why it stands out in the competitive landscape of tax software solutions. We will explore what makes Drake Tax an essential tool for tax preparers, outline its key features, and provide insights into how it can streamline the tax preparation process.

With the ever-evolving tax laws and regulations, tax professionals need reliable tools that can help them manage their workload efficiently. Drake Tax not only simplifies tax preparation but also enhances accuracy and compliance, ensuring that tax preparers can provide the best service to their clients. This article aims to equip tax professionals with the knowledge they need to maximize the potential of Drake Tax in their practices.

As we navigate through this comprehensive guide, we will cover various aspects of Drake Tax, including its features, pricing, user experience, and support options. By the end of this article, readers will have a thorough understanding of how to leverage Drake Tax to improve their tax preparation process and enhance client satisfaction.

Table of Contents

What is Drake Tax?

Drake Tax is an advanced tax preparation software designed for tax professionals and CPA firms. It offers a complete suite of tools that simplify the preparation and filing of individual and business tax returns. With its robust functionality, Drake Tax supports compliance with federal and state regulations, making it a reliable choice for tax preparers.

History of Drake Tax

Founded in 1977, Drake Software has evolved significantly over the decades, adapting to the changing needs of tax professionals. The software has received several updates and improvements, ensuring that users have access to the latest tax laws and features. Today, Drake Tax is recognized as one of the leading tax software solutions in the industry.

Target Audience

Drake Tax is primarily aimed at tax professionals, including CPAs, enrolled agents, and accounting firms. Its comprehensive features cater to firms of all sizes, from small practices to large accounting firms handling a high volume of clients.

Key Features of Drake Tax

Drake Tax offers a wide array of features that streamline the tax preparation process. Some of the most notable features include:

- Comprehensive Tax Forms: Access to a full range of federal and state tax forms, including individual, corporate, partnership, and estate tax returns.

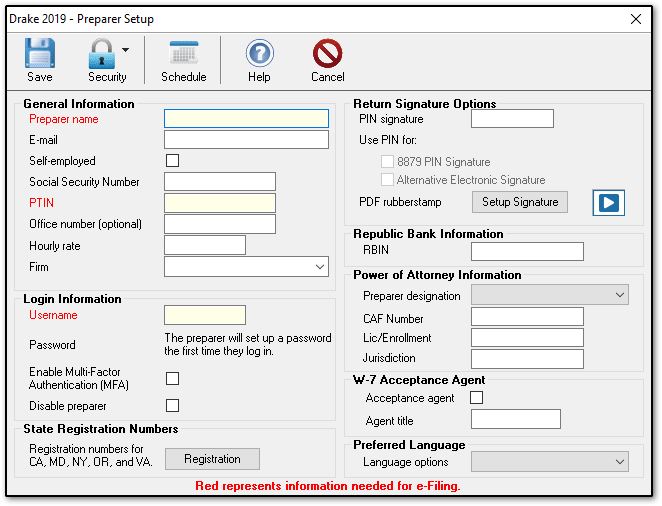

- e-Filing Capabilities: Seamless electronic filing for both federal and state returns, ensuring quick and accurate submissions.

- Client Management: Tools to manage client information, track communications, and maintain accurate records.

- Data Import: Ability to import prior year tax data and financial information from various accounting software.

- Integrated Worksheet: Built-in worksheets to help preparers calculate complex tax scenarios and deductions.

- Collaboration Features: Options for collaboration with clients, allowing them to securely upload documents and access their tax returns.

Benefits of Using Drake Tax

Utilizing Drake Tax in your tax preparation practice comes with numerous advantages:

- Efficiency: The software’s intuitive interface enables tax preparers to work faster and minimize errors.

- Accuracy: Built-in error checks and validation help ensure compliance with tax laws and regulations.

- Customization: Users can customize the software to fit their specific client needs and workflow processes.

- Cost-Effective: Competitive pricing compared to other tax software solutions, providing good value for the features offered.

Pricing and Packages

Drake Tax offers a variety of pricing options to accommodate different needs. The pricing structure typically includes:

- Base Package: A standard package that includes essential features for individual tax preparation.

- Business Modules: Additional modules for corporate, partnership, and non-profit tax preparation at an extra cost.

- Support and Maintenance: Annual fees for ongoing support and software updates.

For the most accurate pricing information, it is recommended to visit the official Drake Software website.

User Experience and Interface

Drake Tax is designed with user experience in mind. The interface is clean and intuitive, allowing users to navigate easily through various features. Key aspects of the user experience include:

- Dashboard Overview: A comprehensive dashboard that provides an overview of tasks, client status, and important notifications.

- Help and Resources: Access to tutorials, guides, and customer support directly from the software.

- Customization Options: Users can tailor the interface to suit their preferences, enhancing their workflow.

Customer Support Options

Drake Software prides itself on providing excellent customer support. Users have access to various support options, including:

- Live Chat: Instant communication with support representatives for quick assistance.

- Phone Support: Dedicated phone lines for customer inquiries and technical support.

- Online Resources: A knowledge base filled with articles, FAQs, and video tutorials.

Drake Tax Integrations

Drake Tax seamlessly integrates with a variety of third-party applications and tools, enhancing its functionality. Some notable integrations include:

- Accounting Software: Compatibility with popular accounting software for data import and export.

- Document Management Systems: Integration with document management tools for efficient document storage and retrieval.

- Financial Planning Tools: Connection with financial planning applications to provide comprehensive services to clients.

Conclusion

In conclusion, Drake Tax is a powerful and versatile tax preparation software that offers a wide range of features designed to meet the needs of tax professionals. Its user-friendly interface, comprehensive capabilities, and excellent customer support make it an ideal choice for CPA firms and tax preparers. By leveraging the tools and functionalities of Drake Tax, tax professionals can enhance their efficiency, accuracy, and overall client satisfaction. We encourage you to explore Drake Tax further and consider how it can benefit your practice.

If you have experiences or questions regarding Drake Tax, feel free to leave your comments below. Sharing insights can help others make informed decisions and improve their tax preparation processes. Don’t forget to check out our other articles for more valuable information!

Thank you for reading, and we look forward to seeing you back on our site for more insightful content.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2ZksbOtyp5krZmoY7W1ucs%3D